The stamp duty calculation is as follows. You pay stamp duty at these rates if after buying the property it is the only residential property you own.

.webp)

Sdlt Stamp Duty Calculator Uk Calculate Stamp Duty Land Tax

Land transfer stamp duty calculator.

. The easiest way to find out how much Stamp Duty you will pay is to use our Stamp Duty Calculator. The additional property rates apply where after the purchase of a residential property for 40000 or more it is not the only residential property you own or part own anywhere in the world and you have not sold or given away your previous main home. 5 tax so stamp duty for this portion 1250.

GST Registration Calculator prior to 2019 XLSX 319MB Determine when your business is liable for GST registration for periods prior to 2019. GST F7 Calculator XLS 561 KB. You usually pay 3 on top of these rates if you own another residential property.

As the property price increases the rate of pay increases within a certain tax bracket with percentages rising when a higher price threshold is reached. It is a top-line gross yield meaning no expenses are considered. Real Property Land - Partnership Transfers.

2 on the next 125000 2500. The dutiable value of the property generally the purchase price or. Punch the details of how much youre paying for your property where youre buying and when you expect to complete into our free calculator to see how much stamp duty youll need to pay.

There is no stamp duty Tax applied to the first 125000. How to calculate the new stamp duty rate. It is advised that for payment of stamp duty the exact calculation may be made as per the provisions contained in the relevant Acts Rules etc.

Service availability and issues. Enter the price location and purpose of the property youre buying and our stamp duty calculator will tell you how much tax youll have to pay on it. Total SDLT 3750.

What is the yield calculation used. Stamp duty and other tax on property. However first home buyers purchasing the new or established home valued between 650000 and 800000 are still eligible for a concessional transfer duty rate.

So for example if you buy a house for 275000 the SDLT you owe is. Use HMRCs SDLT calculator to work out if you qualify and how much youll pay using both rates. 0 on the first 125000 0.

On a property purchased for 750000 the total stamp duty payable would be 50000. The above calculator is only to enables quick and easy access to calculate estimated stamp duty and does not purport to give correct stamp duty calculation in all circumstances. Use our FREE Stamp Duty Calculator.

This calculator works out the land transfer duty previously stamp duty that applies when you buy a Victorian property based on. How much you pay depends on the propertys value what its going to be used for and where in the UK. Stamp Duty Land Tax calculator.

120 per 100 or part thereof whichever is greater. 5 on the final 25000 1250. Enter the figure for the rate you choose in your SDLT return.

You can use HM Revenue and Customs HMRC Stamp Duty Land Tax calculator to work out how much tax youll pay. Check stamp duty rates where you live. As of August 1st 2021 this is no longer available.

Stamp duty is the tax youre required to pay whenever you buy a property. The calculation used is average_weekly_asking_rent 52 average_asking_price expressed as a percentage. 0 tax so total stamp duty paid for this portion of the purchase price 0.

Purchase Price Im a first time buyer Property is a buy-to-let or second home Buyer is a non-UK resident Calculate. Pay Stamp Duty. 2 tax so stamp duty for this portion 2500.

Real Property Land Foreign Ownership Surcharge. 3750 is payable on the first 125000 6250 is payable on the 125000 portion between 125000 250000 and 40000 is payable on 500000 in the next band between 250000 925000. A flat rate of 454 per 100 applied to the total transaction value.

2400 plus 220 per 100 or part thereof by which the value exceeds 200000. Our NSW stamp duty calculator is updated to reflect this change as the Bill was approved in NSW Parliament on 11 August 2020. Rate of stamp duty.

The date of the contract for your property purchase or if there is no contract the date it is transferred. GST Registration Calculator from 2019 Determine when your business is liable for GST registration from calendar year 2019 onward. This calculator has been revised in 2019.

All You Need To Know About The Calculation Of Stamp Duty On Different Instruments Ipleaders

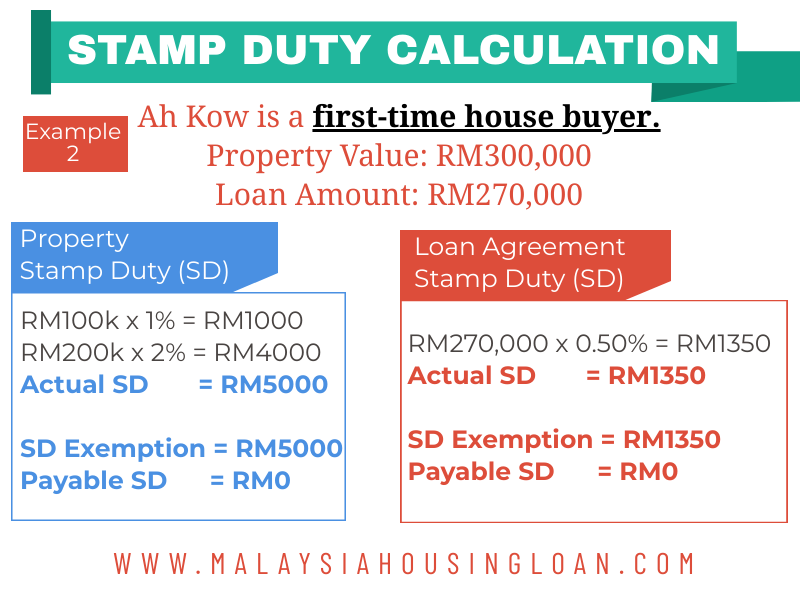

Exemption For Stamp Duty 2020 Malaysia Housing Loan

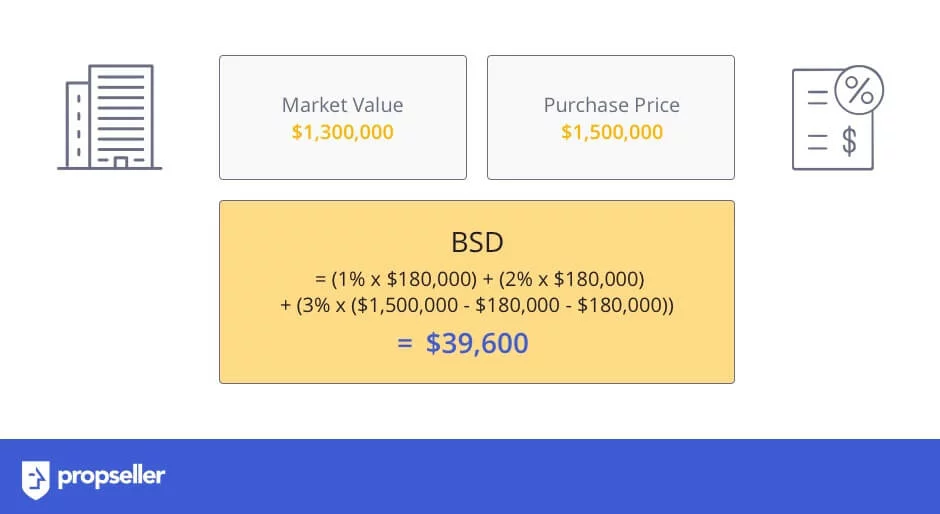

Stamp Duty In Singapore The Ultimate Guide 2020 Update Propseller

Buying A House Here S 2022 Stamp Duty Charges Other Costs Involved

How To Calculate The Savings From Reduced Stamp Duty And Transfer Tax Dig Jamaica

Stamp Duty In Singapore The Ultimate Guide 2020 Update Propseller

Online Stamp Duty Calculator Check Latest Aug 2022 Rates Here

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Stamp Duty Legal Fees New Property Board

Plansoft Calculator Features Stamp Duty

Latest Stamp Duty Charges 6 Other Costs To Consider Before Buying A House In 2019 Cbd Properties

The Complete Guide To Stamp Duty

Stamp Duty Legal Fees New Property Board

Malaysia Property Stamp Duty Calculation Don T Know How To Count Property Stamp Duty Here Is It By Sheldon Property Facebook